ADA Price Prediction: Technical Bearishness Clashes with Long-Term Potential

#ADA

- Technical Breakdown: ADA trades below key moving averages and Bollinger Band support, indicating bearish short-term momentum

- Mixed Fundamentals: Positive partnership news contrasts with whale migration to alternative projects

- Market Context: Broader crypto bearish pressure overwhelms project-specific developments

ADA Price Prediction

ADA Technical Analysis: Bearish Signals Dominate Short-Term Outlook

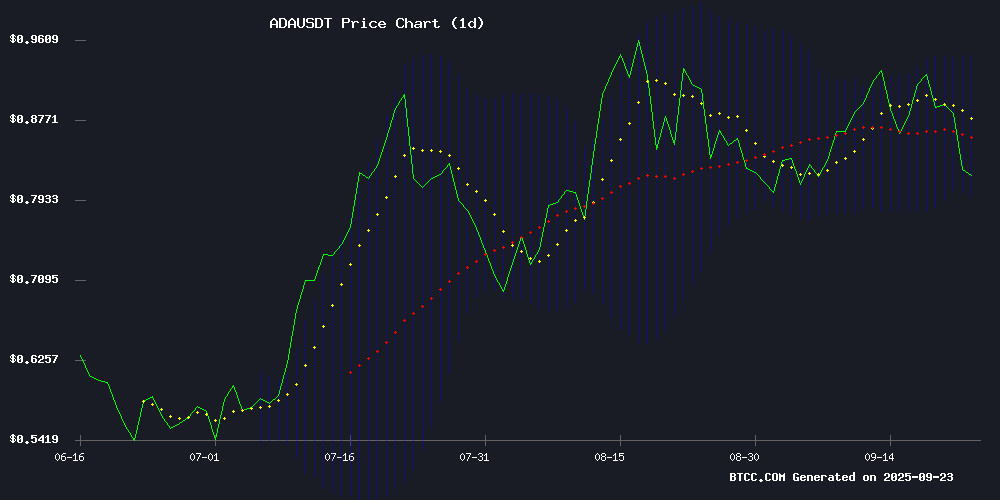

According to BTCC financial analyst Ava, ADA's current technical picture shows concerning signals. Trading at $0.8147, the cryptocurrency sits below its 20-day moving average of $0.8713, indicating short-term bearish momentum. The MACD histogram reading of 0.001154, while slightly positive, remains weak compared to the negative signal line at -0.025416.

Ava notes that ADA has broken below the lower Bollinger Band at $0.7976, which typically suggests oversold conditions but also reflects significant selling pressure. 'The breach of key support levels combined with the MACD's weak momentum creates a cautious technical outlook,' Ava states. 'Traders should watch for consolidation above $0.80 before considering bullish positions.'

Mixed Fundamentals Create Uncertainty for ADA's Trajectory

BTCC financial analyst Ava highlights the conflicting fundamental signals affecting Cardano. While positive developments like Bitrue's seven-year partnership extension provide long-term support, the breaking of key support levels amid market-wide bearish pressure cannot be ignored.

'The whale migration to projects like Remittix shows institutional investors are seeking alternatives despite analyst predictions for 2025 growth,' Ava explains. 'The partnership news is fundamentally positive, but current market sentiment appears dominated by broader crypto market pressures rather than project-specific developments.'

Factors Influencing ADA's Price

Cardano Whales Pivot to Remittix as Analysts Flag 2025 Potential

Cardano's ADA shows resilience at $0.829, with technical charts suggesting a breakout above $0.86 could accelerate momentum. Network upgrades and ETF speculation continue to buoy long-term price predictions, yet sophisticated investors are diversifying into emerging PayFi solutions.

Remittix has emerged as a dark horse in decentralized finance, attracting whale accumulation with its functional cross-border payment rails. The protocol's ability to bridge crypto-to-fiat conversions positions it as a tangible threat to Cardano's remittance-focused growth narrative.

Cardano (ADA) Breaks Key Support Amid Market-Wide Bearish Pressure

Cardano's ADA plunged 4.48% to $0.82, breaching a critical $0.87-$0.90 support zone that had held for weeks. Technical charts suggest further downside risks despite Openbank's integration announcement for 2 million European customers—a landmark institutional adoption milestone.

On-chain data reveals $26.6 million in outflows, reflecting trader exodus as broader crypto market weakness overrides project-specific fundamentals. Charles Hoskinson's roadmap reveal failed to stem the sell-off, with bears now eyeing lower support levels.

Bitrue Marks Seven-Year Partnership with Cardano, Highlights Key Milestones

Singapore's Bitrue exchange commemorated its seventh anniversary by spotlighting its enduring collaboration with Cardano. Since 2018, the platform has grown into a global trading hub, crediting ADA's ecosystem as a catalyst for innovation. Cardano was among Bitrue's inaugural listings, with the exchange becoming the first to support Cardano Native Tokens in 2021.

The partnership deepened with ADA's designation as a base currency in 2022, enabling trading pairs for multiple tokens. Bitrue's anniversary post underscored Cardano's role in its expansion, citing offerings like DJED stablecoin and SNEK—the network's largest token by market cap.

Is ADA a good investment?

Based on current technical and fundamental analysis, ADA presents a mixed investment case. The cryptocurrency currently trades at $0.8147 with several concerning technical indicators:

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $0.8147 | Below 20-day MA |

| 20-day Moving Average | $0.8713 | Resistance Level |

| MACD Histogram | 0.001154 | Weak Positive |

| Bollinger Band Position | Below Lower Band | Oversold |

As BTCC financial analyst Ava notes, 'While long-term partnerships and 2025 growth predictions provide fundamental support, current technical breakdowns suggest caution. Investors should consider dollar-cost averaging rather than large immediate positions until technical stability returns above $0.85.'